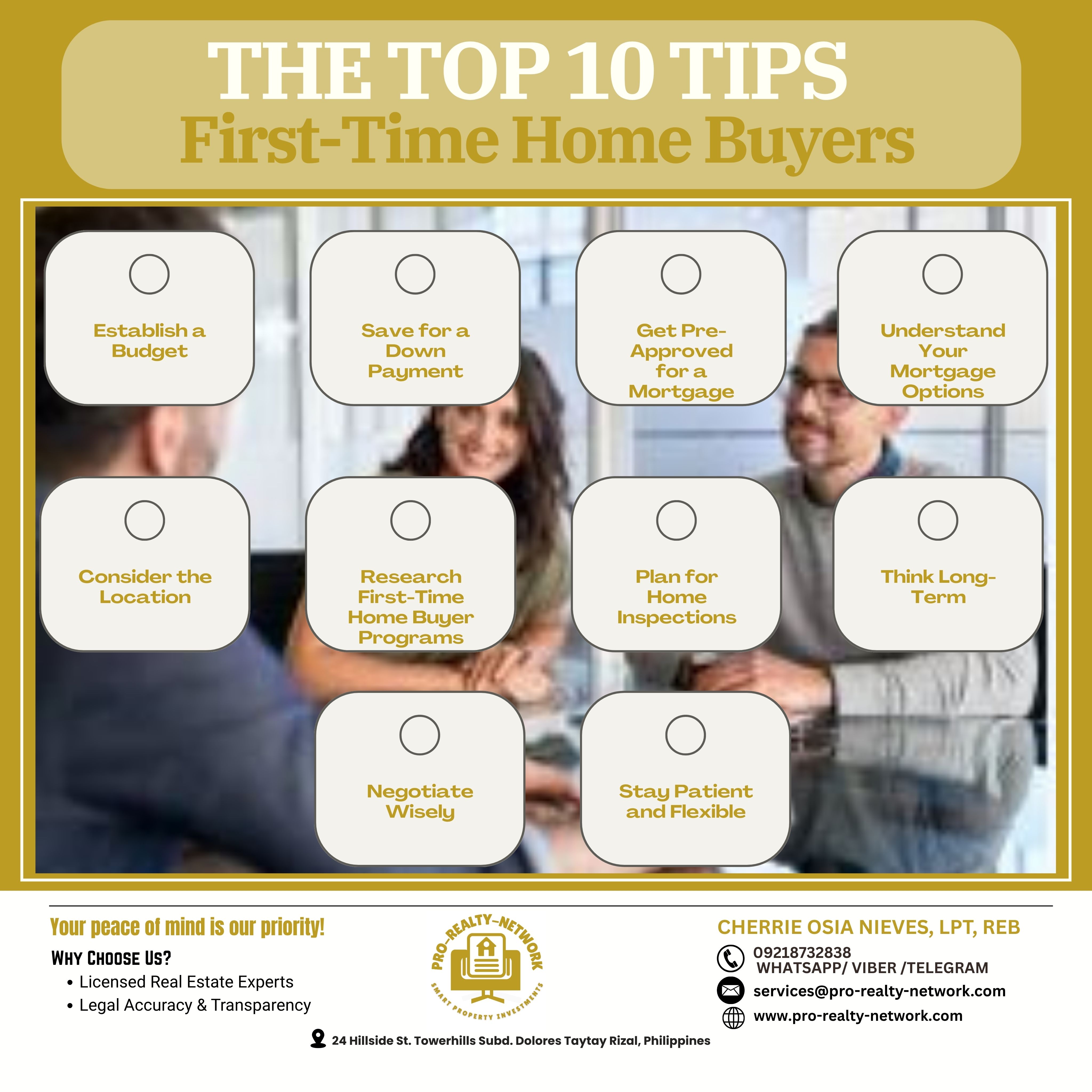

1. Establish a Budget

Before diving into the home buying process, establish a clear budget. Determine how much you can afford by considering your income, debts, and other financial obligations. Utilize online mortgage calculators to estimate your monthly payments, including property taxes, homeowner's insurance, and possibly homeowner's association fees. Remember to allocate funds for closing costs, home inspections, and possible renovations. A clear budget will guide you through financially responsible choices and help you target homes within your price range.

2. Save for a Down Payment

One of the most crucial steps in preparing to buy a home is saving for a down payment. The typical down payment is often 20% of the home's price, which can significantly impact your mortgage rates and private mortgage insurance requirements. However, various loan programs exist that allow lower down payments. Start saving early, and consider automatic transfers to a savings account dedicated to your home purchase.

3. Get Pre-Approved for a Mortgage

Securing mortgage pre-approval is a vital step for first-time home buyers. This involves a lender examining your financial history to determine the amount they are willing to lend you. Pre-approval helps solidify your budget and adds credibility to any offer you might make on a house. Plus, it gives you a competitive edge in a seller’s market and allows you to act swiftly when you find the right home.

4. Understand Your Mortgage Options

Several mortgage options cater to different budgets and financial situations. Fixed-rate mortgages guarantee the same interest rate throughout the loan duration, providing predictable monthly payments. Adjustable-rate mortgages, on the other hand, offer a lower initial rate that changes with market conditions. First-time buyers might also explore government-insured loans that offer benefits such as lower down payments and assistance with closing costs. Weigh the pros and cons of each option to find what best suits your financial health and homeownership goals.

5. Consider the Location

Location is paramount when purchasing real estate. Research potential neighborhoods to understand local amenities, school districts, and crime rates. Consider your commute to work and the accessibility to public transportation. Even if you find an affordable home, an inconvenient or unsafe location could affect your living experience and the future resale value of the property. Visit neighborhoods at different times to get a sense of the community dynamics.

6. Research First-Time Home Buyer Programs

Some government agencies like Pag-Ibig, GSIS, and SSS offer programs to assist first-time home buyers. These programs can provide grants, loans, or tax breaks that make homeownership more accessible. Additionally, look for education programs that can prepare you for the responsibilities of homeownership. Participating in these programs can provide invaluable knowledge and financial benefits. You can browse their website about acquiring Housing Loans.

7. Plan for Home Inspections

Never skip the home inspection. A thorough inspection can reveal hidden problems with a property that could cost significant money to repair. Use a reputable inspector and consider inspections for specific issues like mold, pests, or structural problems depending on the age and condition of the home. The findings from a home inspection can provide leverage in negotiations, allowing you to request repairs or a lower price.

8. Think Long-Term

Buying a home is a substantial and often long-term investment. Consider not just your current needs but also how your life might change in the next 5-10 years. For example, might you need extra rooms for future children or a home office for remote work? Purchasing a home that can accommodate future changes will help prevent the need for premature moving.

9. Negotiate Wisely

Once you find a home that fits your needs and budget, be prepared to negotiate. Your real estate agent can be instrumental in this process, offering insights on whether the listed price is reasonable and how much room there might be for negotiation. Consider asking the seller to cover part of the closing costs or to make repairs based on the home inspection results.

10. Stay Patient and Flexible

The home buying process can be lengthy and complex, filled with potential delays and obstacles. Stay patient and maintain flexibility in your decision-making. Whether it's losing out on a bidding war, needing to adjust your budget, or dealing with paperwork delays, readiness to adapt will make the process more bearable. Remain focused on your ultimate goal of homeownership, and don't rush into decisions that might not be right in the long run.

By following these top 10 tips for first-time home buyers, you can navigate the complex process with a bit more ease and clarity. Preparing financially, understanding all options, and making well-informed decisions will lead you toward a successful and fulfilling purchase.